Subject to Finance in most cases is a condition included in an offer to buy a property.

Some other FAQ’s – Click Here.

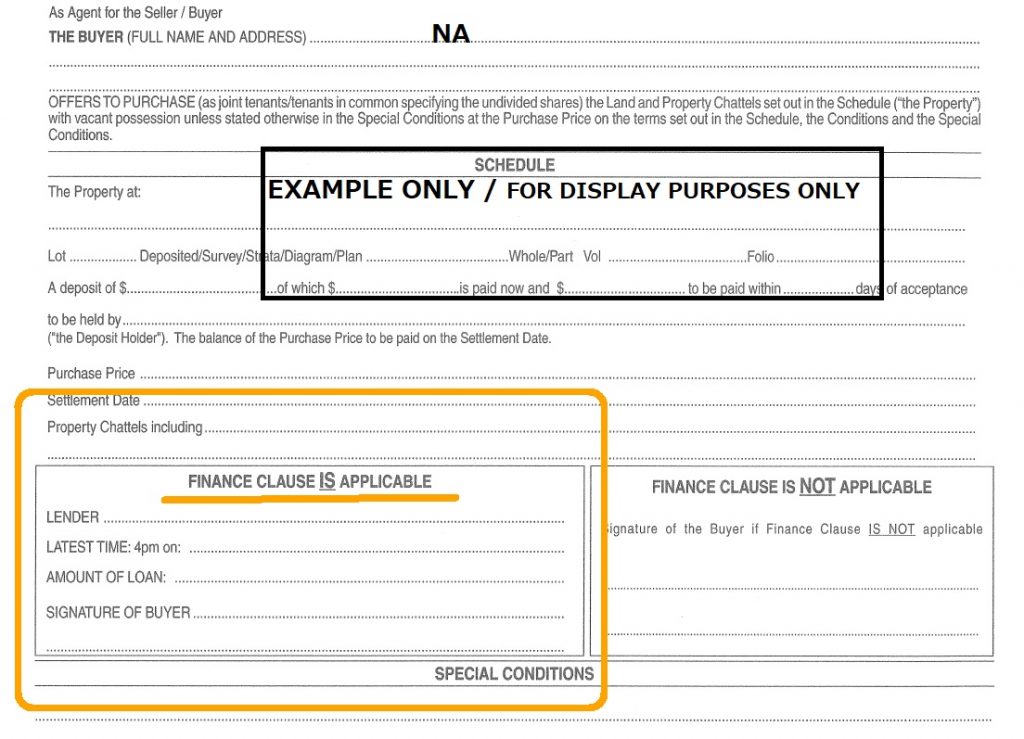

Example – Subject to Finance Clause on an Offer and Acceptance Form.

See the finance clause below marked in the orange box. (Note: the form below is for display purposes only).

Understanding the Offer and Acceptance Form

The subject to finance clause on an Offer and Acceptance form is where you will be required to nominate the maximum amount of finance required in relation to buying the property.

Sometimes the finance figure is written as numbers, ie: $450,000 or a percentage, ie: 80% of the purchase price.

Either way is acceptable.

By filling out the amount it allows the sellers to have an idea of you financial position.

If you are borrowing in excess of 80% you may be asked by the lender to take out mortgage insurance.

Mortgage insurance can soak up more money from your savings/deposit and weaken your chance of obtaining finance.

Sellers are entitled to know how strong your financing ability is to allow them to make an informed decision on how to negotiate with your offer and acceptance form.

The selling agent can assist you with filling in the offer and acceptance form.

Make sure that you ask the real estate agent questions if you are unsure.

Choose a Settlement Agent Early On

At the beginning of your real estate search it is a very good idea to choose a settlement agent and create a relationship with them. Settlement agents will help you understand the sale process and can assist with questions regarding the finance clause.

Settlement agents can provide a source of independent advice rather than solely relying on advice from a home sellers real estate agent.

Settlement agents can explain the ins and outs of an offer and acceptance form and how they assist you along with what documents they need and when they need them by.

What does the Settlement Agent Do?

Settlement agents facilitate between lenders, government authorities and third parties to make sure the settlement of the property you are buying or selling transitions through smoothly through to settlement day.

After An Offer And Acceptance Has Been Signed.

Once an offer has been accepted and signed by all parties, the contract copy is emailed to the buyer and seller’s settlement agents. (Always check that your settlement agent has received this).

Check that they are aware of the settlement date and all other conditions on the contract e.g finance approval, termite inspection, building inspection and any other conditions.

Do you have any questions?

If you have any questions fill in the form below. Click on the submit button at the bottom of the page. We will get back to asap to help you as best as we can.

BENDIGO BANK.

Looking for a bank to consult about your finance?

Try the Bayswater WA branch of the Bendigo Bank – click here.

(This is not a paid promotion. We (Lay2) do not receieve any introduction fees).

Feeling Hungry? Why not try a Bayswater Fish and Chip Shop?

Here are a couple fish and chip shops in Bayswater that I have personally tried and can vouch for!

“Grilled” Fish and Chips Click Here.

“Santorini” Fish and Chips Click Here.